How Pawn Shops in Melbourne Can Help When You Need It

Introduction

Pawn shops provide loans that are collateralized by assets, making them a great option for cash advances. Let’s examine how Melbourne pawn shops operate and how they could help the less fortunate. It might be difficult to find a trustworthy source of fast cash when money is tight or when obligations arise out of the blue. Thankfully, people in need of quick cash have a practical option in pawn shops, which spares them from the inconveniences of filling out standard loan applications.

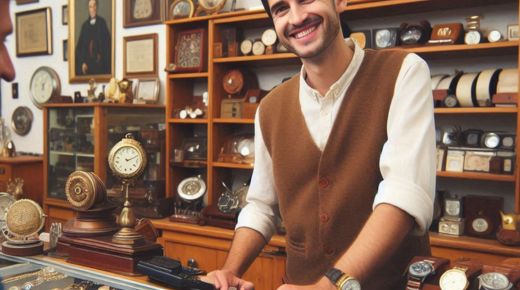

Beyond only buying and selling things, pawn shops provide a variety of services, making them a mainstay of Melbourne’s commercial community for a long time. These businesses offer pawn loans, which are short-term loans where recipients receive money in exchange for personal items pledged as collateral. Because pawn loans don’t require as much documentation as ordinary loans and don’t involve credit checks, anyone with a variety of financial backgrounds can apply for them.

The main advantages of pawn loans are their speed and simplicity of use. For those in need of quick cash for unforeseen expenses like auto repairs or medical bills, pawn shops are a convenient option. As collateral, you can accept a wide range of items; nonetheless, costly goods, jewelry, electronics, and musical instruments are frequently accepted. The loan offer is based on the appraised value of the item, which is determined by the pawnbroker.

A Pawn shop Melbourne follow laws established by regional and state agencies to guarantee honest and open dealings. A ticket, also known as a pawn receipt, is given to the borrower outlining all the details of the loan, including the principal amount, interest rate, and payback schedule. Even though pawn loans may have higher interest rates than typical loans, they can be a useful alternative for people who are short on cash or don’t have access to other credit choices.

After the loan terms are finalized, borrowers receive instant cash, which enables them to meet their immediate financial obligations. While the loan is being repaid, their collateral is stored in a secure location. Borrowers have a certain period of time, usually one to three months, in which to return the loan and pick up their possessions. If borrowers are unable to return the loan in full, they are free to manage their finances as they see fit. By making the cumulative interest payment, they have the option to extend the loan period.

For consumers wishing to quickly get rid of their belongings, pawn shops also provide the option of outright products sales. Selling goods to a pawn shop could be an easy option to earn cash if you’re short on cash or are downsizing. Furthermore, pawn shops typically carry a wide range of pre-owned things at low prices, providing value to customers looking for premium products at reasonable prices.

Selecting a respectable business with a history of professionalism and ethics is crucial when looking at pawn shops in Melbourne. By reading internet reviews, verifying accreditation and licensure, and getting referrals from friends and family, you can locate reliable pawnbrokers. Having a good working relationship with a trustworthy pawn shop can provide you piece of mind by guaranteeing that you can get the money you need when you need it in an ethical and timely manner.

Conclusion

In conclusion, Melbourne’s pawn shops are essential to helping those in need of financial support. Through the use of pawn loans and outright sales, these businesses make it easy to acquire cash quickly without having to deal with the red tape of traditional lending institutions. Through comprehension of pawn shop operations and responsible utilization of their services, customers can confidently and easily manage financial matters.